stash invest tax documents

I just checked my account and tax documents are finally available for 2019. You made a withdrawal from your Stash Retire IRA of 10 or more or.

How Investments Are Taxed Stash Learn

You sold an investment in your Stash Invest account in 2021.

. Type Apex and select Apex Clearing. As part of the 19 trillion stimulus package known as the American Rescue Plan the IRS increased the child tax credit for children under the age of six to 3600 and for children between six and 17 to 3000 from its current 2000 per child. Stash Tax Forms Available.

You received dividend payments greater than 10 from your Stash Invest accounts in 2021. You received dividend payments greater than 10 from your Stash Invest investments in 2021. Copy or screenshot your account number and type of tax.

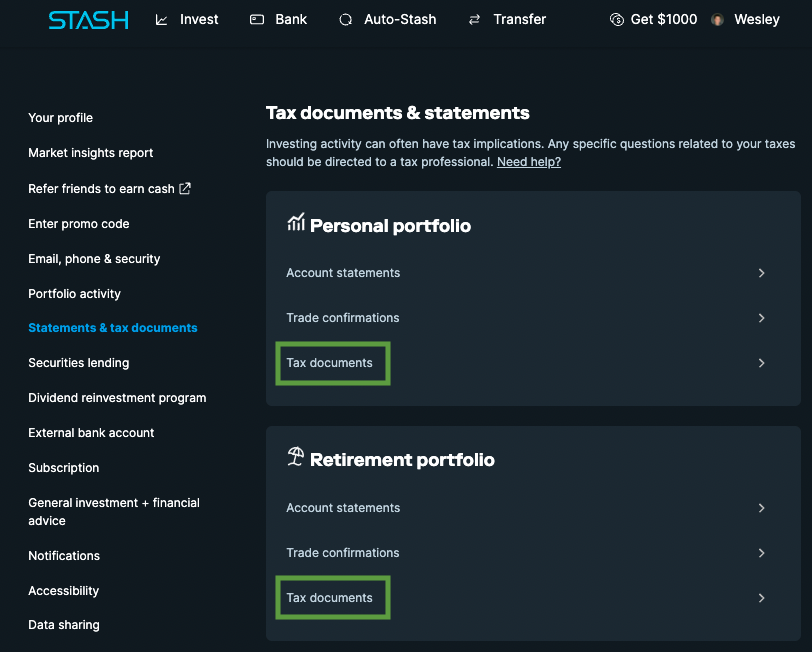

The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents. It went to TurboTax TPG and was sent from them to my bank account on the 18th. So just a heads-up for those of you waiting on this to file your taxes.

Market data by Thomson Reuters Refinitiv. Stash 8949 Form 1099-B I got a 1099 from stash. The 1099-B is a tax form sent to you from Stash so that you can report any gains or losses from selling stocks mutual funds or EFTs during the year.

Have 2021 tax documents shown up in anyones account yet. And procedures in place as well as the administrative capability to protect a significant investment of taxpayer dollars. It includes a personal investment account the Stock-Back Card 1 saving tools personalized advice and 1000 of life insurance coverage through Avibra.

You may not have 2021 tax documents for all. It can work for first-time budgeters and investors. And heres a bonusTurboTax offers Stashers up to 20 off federal tax prep.

Stash Invest accounts are taxable brokerage accounts. You have a retirement account with Stash and havent made any withdrawals. Login to your Stash account.

You are required by the IRS to report income earned from capital gains and other applicable distributions. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser. Its common for attackers to target popular tax filing and preparation apps such as Intuit and TurboTax in.

Firm Details for STASH INVEST Location. Will I Have Tax Documents from Stash. You made a withdrawal from your Stash Retire IRA of 10 or more.

The final plan was circulated for comment and then approved in March 2017. You likely wont have tax documents if. This was my first year trading etrade and robinhood both say Feb 15th.

Come talk about Stash investing and personal finance. The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents. Click Tax Documents for each Stash account.

The Password will be your SS. Its under Statements and Tax Documents once you click on your name at least on Desktop. Is a digital financial services company offering financial products for US.

Stash will email you when your tax forms become available. Get started with. Stash will email you when your tax forms become available.

Copy or screenshot your account number and type of tax document is. Have made money from selling investments. The plan was developed through 3 organization-wide retreats that involved 20 leaders from our board and working committees.

You should have tax documents from Stash if. You can access historical documents year round Tax Documents section of Account Management. Stash is not a bank or depository institution licensed in any jurisdiction.

You should consult with a tax or legal professional to address your particular situation. Take a few minutes to read our community guidelines. Im getting very upset.

You sold an investment in your Stash Invest account in. You may be eligible to receive a 1099 form if your investment activity with Acorns last year meets IRS report. Products offered by Stash Investments LLC and Stash Capital LLC are Not FDIC Insured Not Bank Guaranteed and May Lose Value.

If you do not have a 1099 form from Stash then you do not have anything to report on your tax return. You likely wont have tax documents if. This Community Investment Plan is an updated version of Wellsprings three year Strategic Plan that was adopted by the organization in 2017.

If you will receive Stash tax forms they should be available on or before February 16 2021 in the Stash app or on the web find them here. You can access historical documents year round Tax Documents section of Account Management. Stash Growth costs 3month.

Each year Stash will send you tax documents so that you can file your taxes appropriately. You should have tax documents from Stash if. Is a digital financial services company offering financial products for US.

Please consult your tax. In TurboTax select the financial section that corresponds to your 1099 type. Under Apex Username type 10- and the Stash account number located at the top of your 1099 proved by Stash.

Stash will make your relevant tax documents available online in mid February. If you do have a 1099 B form here are the steps to follow to enter any investment gainslosses on sales. Acorns does not provide tax or legal advice.

Except its not in my bank account and today is the 23rd. If unsuccessful youve likely selected the incorrect entry screen. For my tax document a lot of Date Acquired box 1b information are missing.

It says they may not be posted until February. MA Community Investment Tax Credit 500 1250 2500 5000 150000 Federal Tax Deduction 35 175 438 875 1750 52500 Total Tax Savings 675 1688 3375 6750 202500 Estimated Final Out-of-Pocket Donation 325 835 1625 3250 97500 Example of 35 tax bracket used for illustration purposes only. You received more than 10 in interest on your Stash Invest account.

You received more than 10 in interest on your Stash Invest account. Now you can automatically upload your Stash tax documents with TurboTax. Stash will make your relevant tax.

It can work for people who want to expand their long-term wealth building plan. Only enter account numbers for Stash accounts with 2021 tax documents listed. 1099-DIV 1099-B etc at the top of pg.

This form is sent to you by Stash if you earned more than 10 in dividends from EFTS or mutual funds OR if you earned any divided directly from a stock. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser. You received less than 10 of interest andor did not sell any investments before the end of 2020.

If you have tax documents available. 1 online tax filing solution for self. Stash is not a bank or depository institution licensed in any jurisdiction.

If you have not received a 1099 form from Stash you should check your online Stash account to see if a 1099 form has been provided for you. I decided to send my tax refund to my bank account with stash. Another thing to take into consideration is the increased Child Tax Credit which began in July 2021.

In order to help strengthen its procedures and ensure that future development opportunities proceed in the best interests of the Town of Belchertown and the Commonwealth BEDIC should.

Online Tax Resource Center Stash

/stash-vs-wealthfront-68305a0271ce446f9208a17ac16df7bf.jpg)

Stash Vs Wealthfront Which Is Best For You

Turbotax Direct Import Instructions Official Stash Support

Stash 1099 Tax Documents Youtube

Online Tax Resource Center Stash

Stash Invest App Review 2021 Warrior Trading

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

Stash Review Pros Cons And Who Should Open An Account

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/I5ZXM6LCQVFX3EY5SVTGXY6JOI.png)

Stash Review Read Before You Download Stash Invest App The Dough Roller

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Online Tax Resource Center Stash